Prices

The remittance industry is a big business, according to the latest figures published on the World Bank website, global remittances are expected to increase by 4.6% to $642 billion in 2018. Remittance inflows improved in all regions and the top remittance recipients were India with $69 billion, followed by China ($64 billion), the Philippines ($33 billion), Mexico ($31 billion),Nigeria ($22 billion), and Egypt ($20 billion). India had in 2016 received remittance of 62.7 billion.

The Global Average Cost:

According to the report, the global average cost for sending money recorded a slight increase from 7.09 in Q4 2017 to 7.13% in Q1 2018. An over year decrease compared to Q1 2017, when this figure was recorded at 7.45%.

Banks remainthe most expensive type of service provider, with an average cost of 10.57%.

International MTO Index:

The International MTO Index tracks the prices of MTOs that are present in at lease 85% of the corridors covered in the RPW (Remittance Prices World-wide)database. In 2018, the International MTO Index remained stable, recording a slight decrease to 8.16% from the previous value of 8.23% in Q4 2017.

Global Weighted Average:

In addition to the global average, a weighted average total cost is calculated, which accounts for the relative size of the flows in each remittance corridors. The global weighted average in Q1 2018 has remained stable, recorded at 5.23 percent. This marks the fourth consecutive quarterly decrease of this figure recorded at 5.65 percent in Q1 2017.

Technology

The Block-Chain Technology:

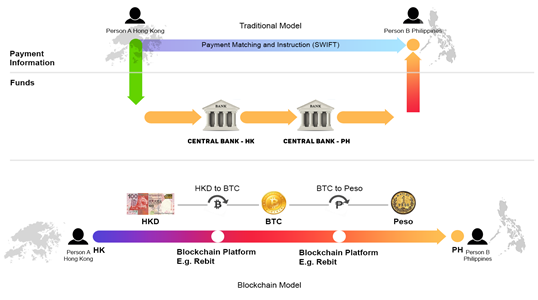

With theadvent of digital currency and blockchain technology, remittance companies arenot holding back in adopting currencies like bitcoin to enable remittanceservices. With these adoption companies are trying to solve multiple issuessuch as high transfer cost, limited money distribution methods, limited brandoptions, limited ways to deal with money, etc.

Anelectronic decentralized ledger would enable all participants in aninternational trade finance transaction ? the bank, the importer, and exporterto access data in real-time. Documentation and record of authenticableownership, along with the transfer of assets would be streamlined digitally, inreal-time, on a tamper-proof ledger.

Blockchain-based settlements can reduce the friction of domestic and cross-border transfers between banks. Using the blockchain in this fashion will not only lead to morevalue accretion to remitting customers, but it will also be the kind of radical value proposition improvement that will be required to attract customers and break them from established habits around sending and receiving money.Similarly, the blockchain can be used in remittances to enhance pricing transparency and provide better transfer security, as well as be used as anon-ramp for other technology-driven financial services.

Leave a Reply